All Categories

Featured

State Ranch representatives sell whatever from house owners to automobile, life, and various other preferred insurance coverage items. So it's very easy for agents to bundle services for discount rates and very easy plan management. Several clients appreciate having actually one relied on agent take care of all their insurance coverage needs. State Ranch provides global, survivorship, and joint global life insurance policy policies.

State Ranch life insurance policy is generally conventional, providing stable options for the typical American household. However, if you're looking for the wealth-building chances of global life, State Ranch lacks competitive options. Review our State Farm Life insurance policy review. Nationwide Life Insurance Policy sells all types of global life insurance policy: global, variable global, indexed universal, and universal survivorship policies.

Still, Nationwide life insurance policy plans are very easily accessible to American family members. It helps interested events get their foot in the door with a reputable life insurance plan without the much more complex conversations about financial investments, monetary indices, etc.

Nationwide loads the important function of getting reluctant buyers in the door. Even if the worst happens and you can't obtain a bigger plan, having the defense of a Nationwide life insurance policy policy can transform a customer's end-of-life experience. Review our Nationwide Life insurance policy evaluation. Insurance provider use medical examinations to assess your risk class when getting life insurance policy.

Purchasers have the choice to alter rates each month based on life circumstances. A MassMutual life insurance agent or monetary advisor can help customers make strategies with area for changes to meet short-term and long-term economic goals.

Universal Life Insurance Comparisons

Some purchasers might be stunned that it offers its life insurance coverage plans to the general public. Still, army participants appreciate one-of-a-kind benefits. Your USAA plan comes with a Life Event Choice rider.

VULs include the greatest danger and one of the most prospective gains. If your plan doesn't have a no-lapse warranty, you might also shed coverage if your cash money value dips below a particular threshold. With a lot riding on your investments, VULs call for constant attention and upkeep. As such, it might not be a fantastic option for people that simply desire a fatality benefit.

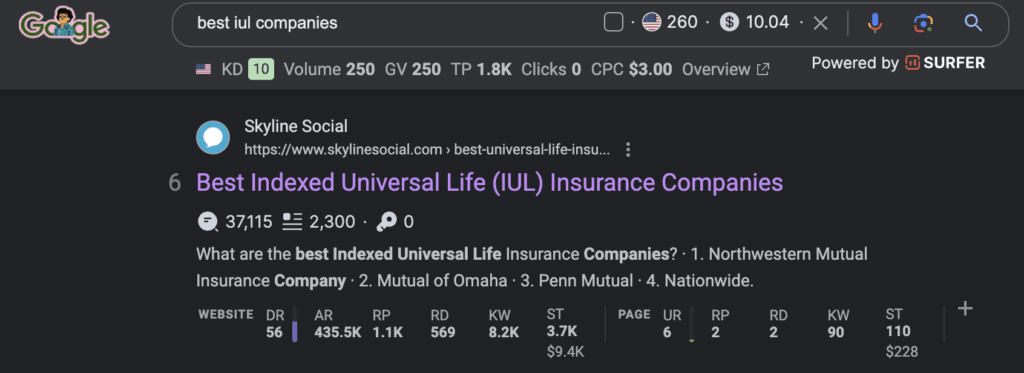

There's a handful of metrics by which you can evaluate an insurer. The J.D. Power client satisfaction rating is a good choice if you desire a concept of exactly how clients like their insurance plan. AM Finest's monetary stamina rating is an additional essential metric to think about when selecting an universal life insurance policy business.

This is particularly crucial, as your cash money worth grows based on the financial investment alternatives that an insurer uses. You must see what financial investment alternatives your insurance policy company deals and compare it versus the objectives you have for your plan. The most effective method to find life insurance is to collect quotes from as numerous life insurance policy firms as you can to comprehend what you'll pay with each plan.

Latest Posts

Guaranteed Universal Life Insurance Definition

Universal Insurance Logo

What Is Fixed Universal Life Insurance