All Categories

Featured

State Ranch agents market whatever from property owners to vehicle, life, and other preferred insurance policy products. State Ranch provides universal, survivorship, and joint global life insurance coverage policies - equity indexed whole life policy.

State Ranch life insurance coverage is typically conventional, offering secure choices for the ordinary American family. If you're looking for the wealth-building possibilities of global life, State Ranch does not have competitive options.

It does not have a solid existence in other economic products (like universal plans that open up the door for wealth-building). Still, Nationwide life insurance policy plans are extremely obtainable to American families. The application process can additionally be more convenient. It helps interested events obtain their means of access with a reliable life insurance policy strategy without the a lot more complex conversations concerning investments, economic indices, and so on.

Even if the worst takes place and you can't get a bigger strategy, having the defense of a Nationwide life insurance policy can transform a customer's end-of-life experience. Insurance coverage firms make use of medical exams to determine your danger class when applying for life insurance policy.

Purchasers have the option to transform prices each month based on life circumstances. A MassMutual life insurance agent or economic consultant can aid purchasers make strategies with area for modifications to satisfy short-term and long-lasting monetary goals.

What Is Better Term Or Universal Life Insurance

Review our MassMutual life insurance policy evaluation. USAA Life Insurance Policy is recognized for providing budget friendly and thorough financial products to army members. Some customers might be amazed that it supplies its life insurance policy plans to the public. Still, army members take pleasure in one-of-a-kind benefits. For example, your USAA policy comes with a Life Event Option motorcyclist.

If your policy does not have a no-lapse warranty, you may also shed insurance coverage if your money worth dips below a specific threshold. It might not be an excellent alternative for people who simply desire a death advantage.

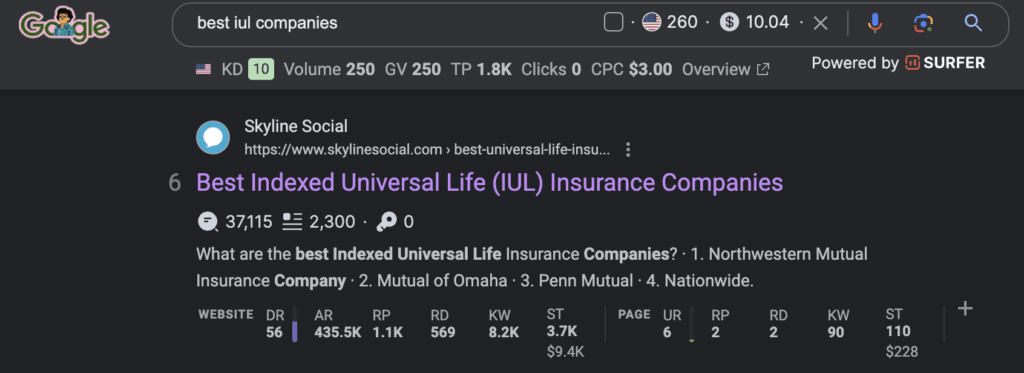

There's a handful of metrics whereby you can evaluate an insurance provider. The J.D. Power customer fulfillment score is a great option if you want a concept of how clients like their insurance coverage. AM Best's monetary strength score is another important statistics to consider when picking an universal life insurance policy firm.

This is particularly important, as your cash worth expands based on the investment alternatives that an insurance provider provides. You must see what financial investment alternatives your insurance service provider deals and compare it versus the goals you have for your plan. The most effective means to find life insurance is to collect quotes from as lots of life insurance policy business as you can to comprehend what you'll pay with each plan.

Latest Posts

Guaranteed Universal Life Insurance Definition

Universal Insurance Logo

What Is Fixed Universal Life Insurance